Twelve Capital Event Update

29 January 2025Wildfires in Los Angeles

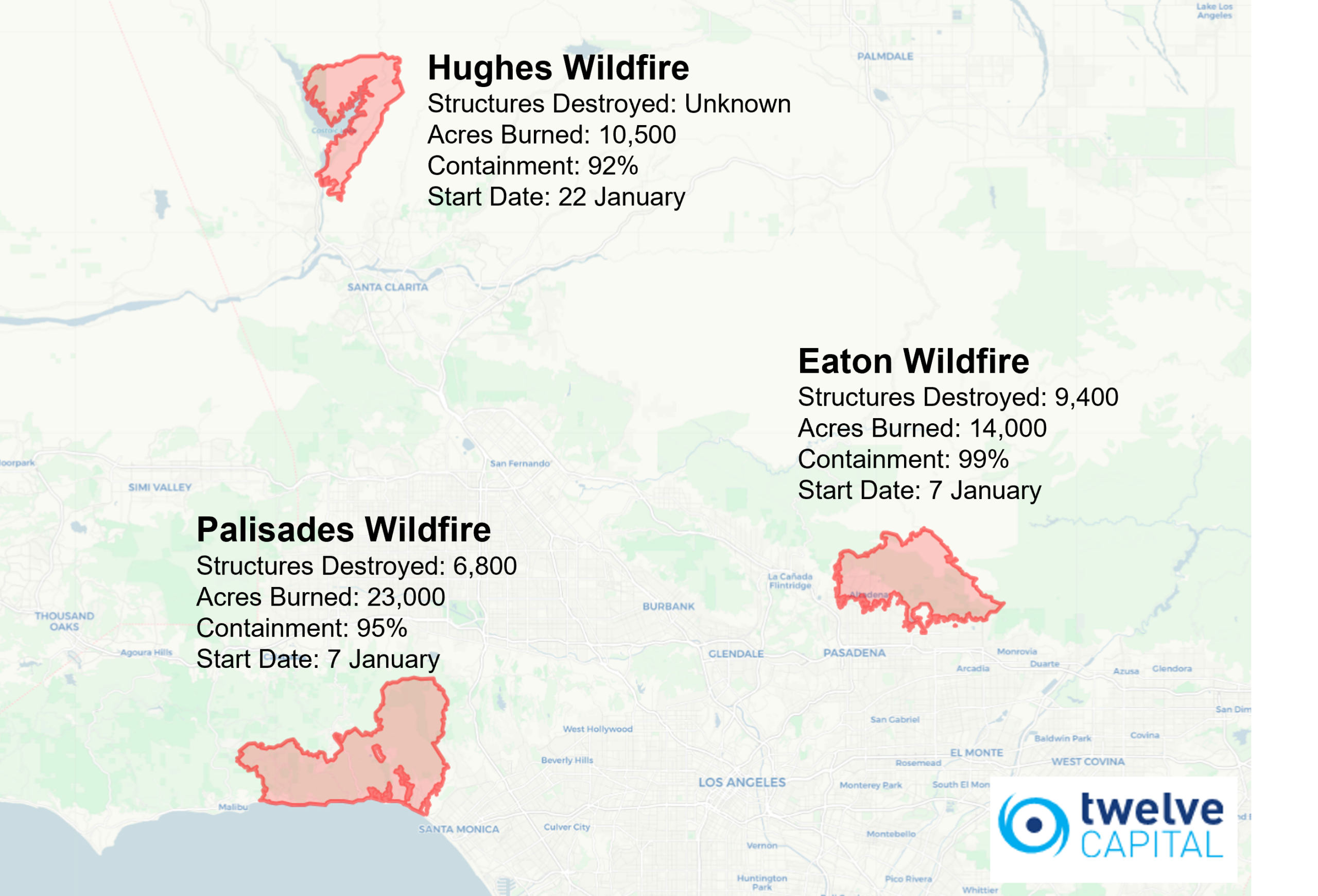

Since Tuesday, 7 January, unseasonably dry conditions and strong Santa Ana winds have fuelled wildfires across Southern California. The two main fires of concern, the Eaton and Palisades fires, have significantly impacted the greater Los Angeles area. The Eaton fire has burned approximately 14,000 acres and damaged over 9,000 structures, while the Palisades fire has burned over 23,000 acres and damaged nearly 7,000 structures. Encouragingly, recent rainfall has aided firefighting efforts, leading to strong progress in containment. Containment refers to the percentage of the fire where control lines have been established to prevent further spreading. The Eaton fire is 95% contained, while the Palisades fire is 90% contained.

Other fires have recently ignited in the region. The Hughes fire, located further north of Los Angeles, has burned 10,500 acres but is now 92% contained. In the San Diego area, several fires emerged this week, including the Border 2 fire, which has burned 6,500 acres and is 40% contained.

Insured losses are expected to be in the range of USD 20-45bn (Source: Artemis). This estimate reflects the high-value real estate areas affected, including Santa Monica and Malibu, where individual homes and properties are often valued in the USD millions. The majority of insured losses are expected to be absorbed by primary insurers and junior reinsurance layers. We believe that there are currently two Cat Bonds with occurrence structures that are affected at this stage. However, we completely excluded one of them and are underweight with the other relative to its market weight, limiting the impact on our portfolio. As noted in our previous updates, the wildfires have contributed to an erosion of the attachment point in aggregate structures meaning it reduces the severity threshold for future events to trigger losses. While the full extent of the aggregate erosion is still being assessed, we are actively monitoring the situation and are awaiting further loss updates from cedants.

Source: Twelve Capital. As at 28 January 2025.